Consulting Services

USE OUR TOOLS FOR YOUR CLIENTS

Choose between our tools to create reports for your clients and reissue compliant invoices

DON’T GIVE AWAY YOUR CLIENTS

Travel & Expenses

Accounts Payable

Consulting Services

TAX RECOVERY

%

UK VAT RATE

%

GERMAN MWST RATE

%

MINERAL OIL VAT RATE

%

SWEDEN MOMS RATE

WHY USE OUR TOOLS

THE PROBLEM

We know that your company is always striving to give further value add services to your clients. The problem is that you don’t want to refer your clients to other companies.

Firstly, you want to keep your clients in house. Secondly, you can’t rely on other companies to give the same level of service to your clients. Thirdly, you don’t want to share sensitive information with another company.

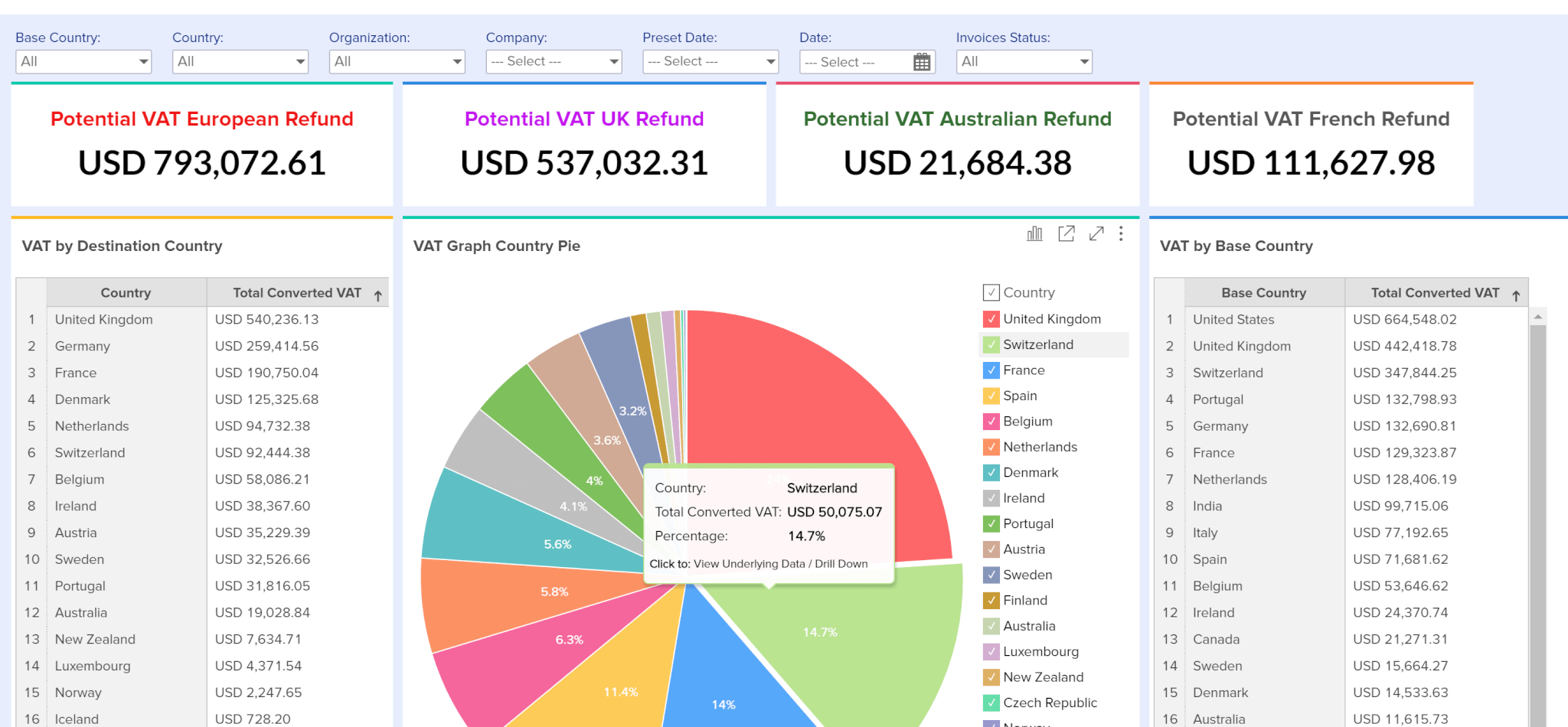

The VAT reclaim potential can be millions of dollars for your clients. But VAT & Tax recovery can be challenging and requires a detailed understanding of the complex processes and requirements in each international country, as well as proficiency in each language.

Perhaps the biggest challenge is sorting through all your clients data. There can be millions of lines of expenses and you also need to organize all the data into local and international tax tracking and refund opportunities. You will need organize the data according to company, base country, destination country, international vs local taxes etc.

Another significant challenge is ensuring your client has compliant invoices. Unfortunately, most employees just upload credit card receipts and when actual invoices are uploaded, they are missing required compliment details.

THE SOLUTION

The Global VaTax group has the technology and experience to ensure that you get full and detailed reports with drill down capabilities.

We offer comprehensive reports which will give you all your data organized and collated. The best part is that we have easy integration into the main expense management systems.

We also offer reissuing invoices services at a fraction of the cost and offer consulting to take you through the accounting process.

You can choose the service that you need in order to keep your clients in house without having to refer them to second party.

VATAX CLOUD

VaTax Cloud streamlines the VAT & Tax recording and recovery process. We electronically retrieve your data and invoices from any travel expense management system or you can send us an extracted Excel file via your encrypted portal. Implementing complex VAT calculations, receipts extraction and OCR technology, you can be assured that no VAT claim will go unnoticed.