Expense types

Subject to the different regulations and VAT rates, which vary from country to country and expense type, a US company can receive a VAT Refund on business Travel & Expenses and Accounts Payable.

What we RECOVER

Travel & Expenses

VAT refund on international Travel & Expenses. Hotels, Entertainment and VAT Registration.

Corporate Expenditure

Research and Developement

VAT is often charged on Research and Development services from international vendors like hospitals, clinics and research centres.

Conferences

Haulage and Fuel

Haulage companies and fuel costs can have up to 30% charged on international invoices.

Import & Drop Shipping

Fees & Marketing

Inter-Company

VAT is charged on Inter-Company invoices to US Companies from its European subsidiaries.

Tours & Movies

Frequently Asked Questions

What are our fees?

What is VAT?

The United States has a sales tax system, however other countries have a Value Added Tax (VAT) system. What is VAT?

Value Added Tax (VAT) is a consumption tax, which ranges between 8 – 25%, that is levied on both goods and services in most international countries.The national tax systems of Europe, UK, Canada, Japan, South Korea and Australia allow for a refund of VAT – Tax to most non-resident business entities worldwide. In most cases, US companies should be eligible for a VAT refund for business done internationally.

VAT rates and regulations differ for each expense type, and from country to country. Below is an illustration of a US company that paid for a conference for its employees in England:

| XYZ Conference | €100,000.00 |

| 20% VAT | €20,000.00 |

| ————– | |

| Total Paid to XYZ Conference | €120,000.00 |

Global VaTax would apply for a €20,000 VAT refund for the US company with the UK tax authorities and convert the reclaim into $ and wire the refund, minus our fees.

Who is entitled to a refund?

What documents will you need?

How big is our network?

What is the extent of the cash recovery?

How long will it take?

Why use Global VaTax's management services?

The local tax authorities require that the application and the communication are done in their own language. Global VaTax makes it convenient for your company to collect its VAT refund and manage its VAT registration. We communicate with the local tax authorities, and we understand and have experience with their unique requirements and rules.

You will also have access to the VaTax Cloud encrypted private online portal where you can track progress, with live interactive data.

We have the necessary knowledge and experience to expedite your claims for prompt returns and maximize payments. We can also assist with efficiently structuring your organization’s financial and operational processes for ongoing VAT registrations and management.

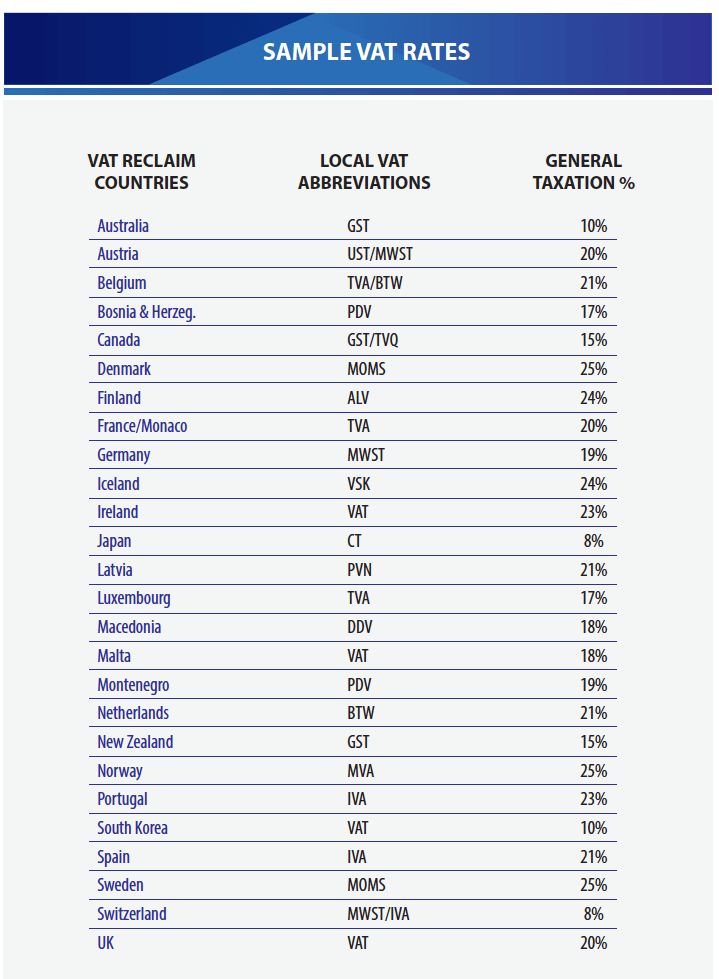

Sample VAT RATES

These are general VAT Rates in each country. When we create your VAT Potential Analysis Report, there will be different VAT rates per expense type, in each country. Our VaTax Cloud computes the exact VAT rates and prepares your submission.

After we begin the submission process, you will be able to track the process in real time via the Submission Analysis Report.

You can be sure that no VAT charges will go unnoticed and we recover the maximum VAT reclaim.