VaTax Cloud

Fast, Automated and Maximum International VAT Recovery

EXTRACTION

Expenses and invoices are extracted via API from your Expense Management System. Excel upload is also possible.

REPORTS

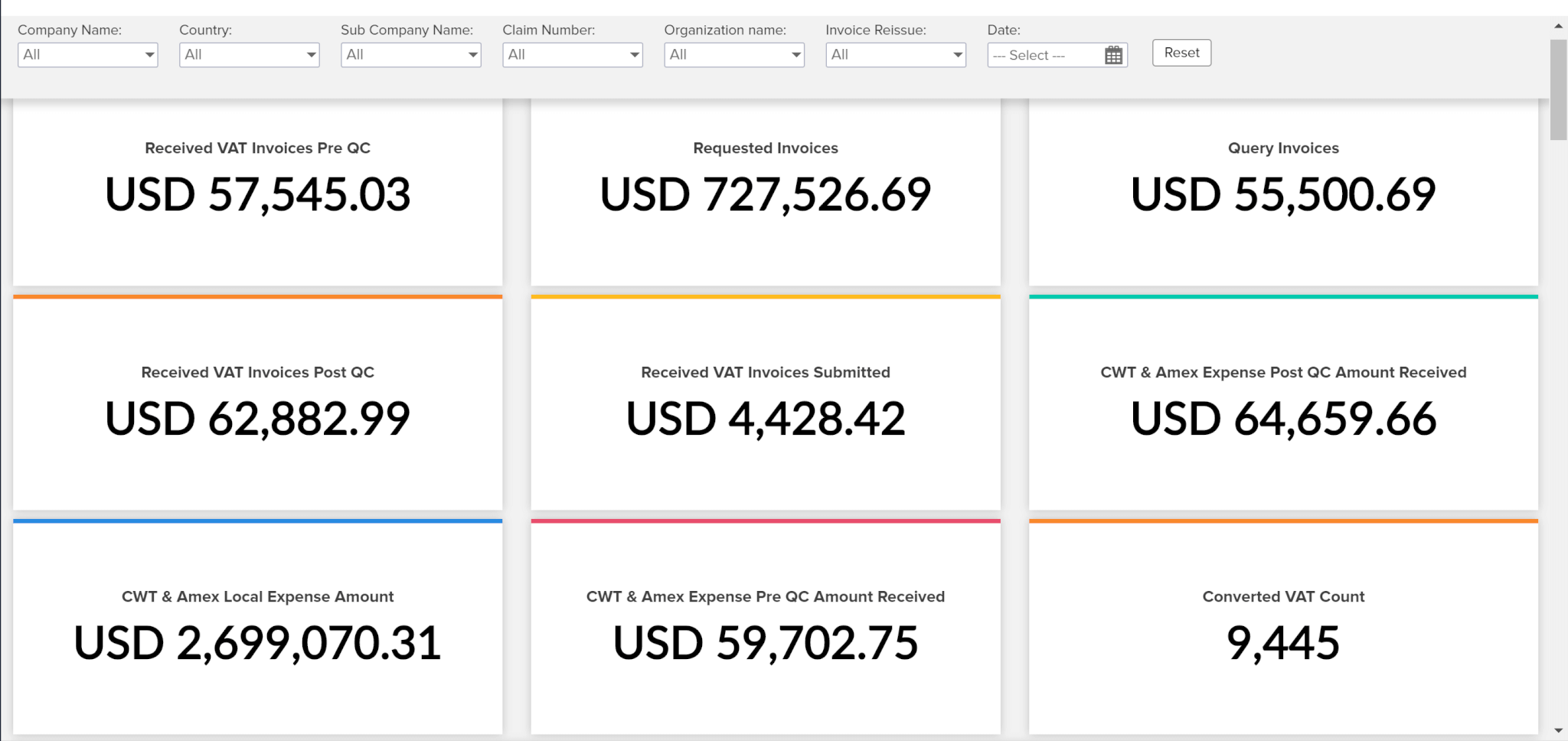

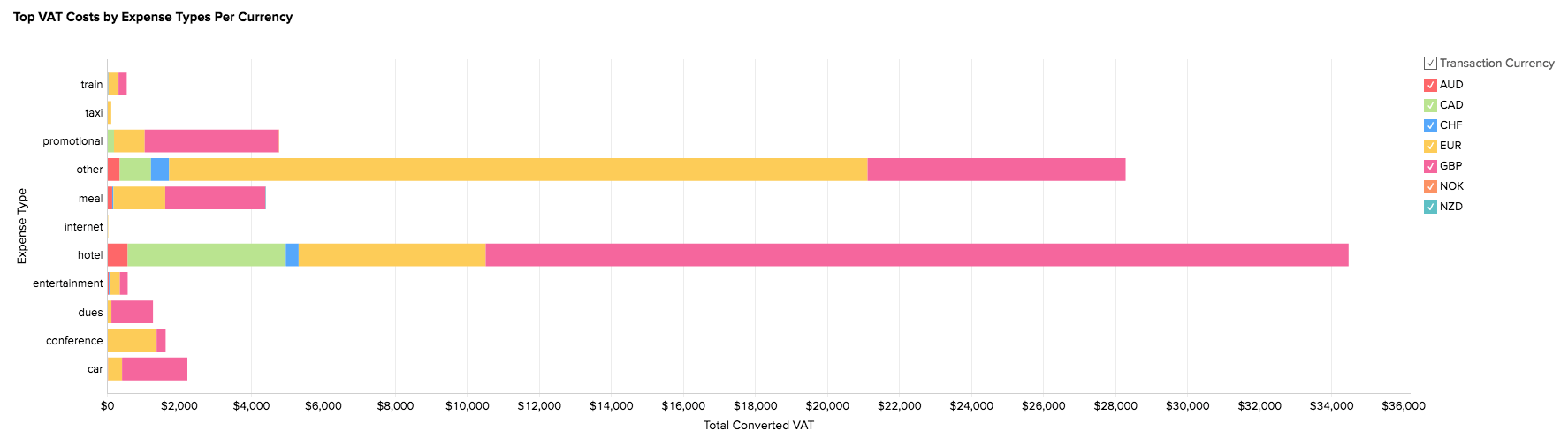

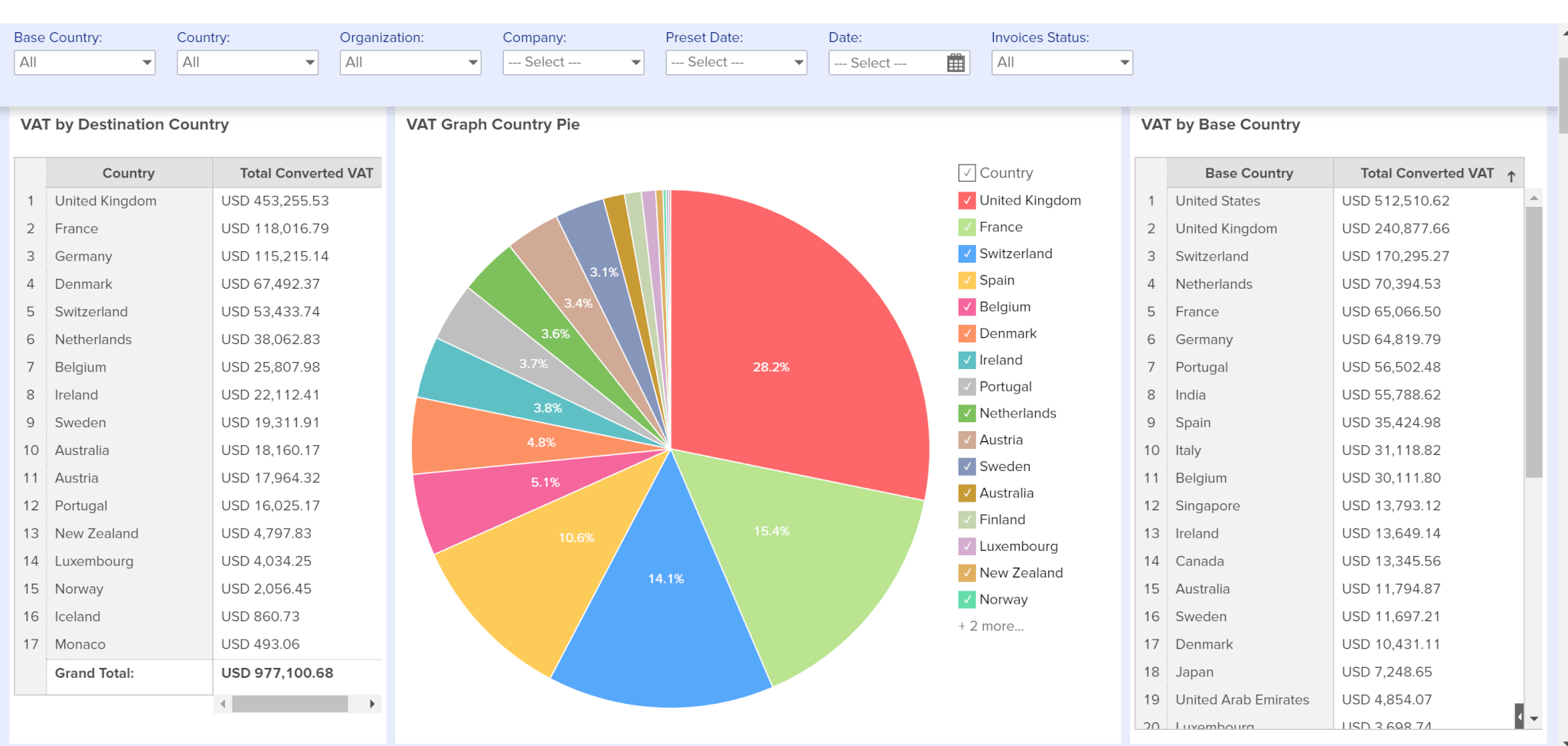

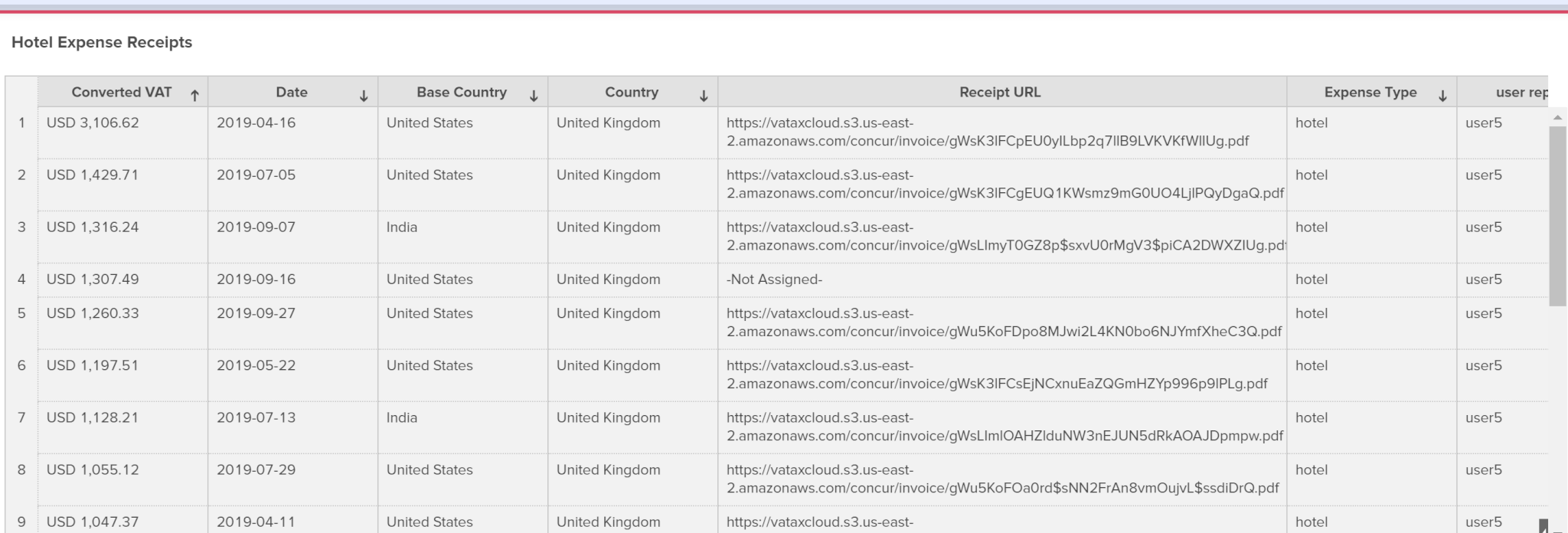

After VAT rates are calculated by our backend algorithms and OCR technology, you will have online access to your VAT Reports. All charts are interactive and have drill-down capabilities.

SUBMISSION

Manual Reconciliation, VAT compliance, and Submission to government tax offices until you receive your VAT refund.

Our software uses sophisticated OCR technology to read all invoice formats, flag all VAT eligible invoices and input the necessary data, regardless of how employees enter their expenses in the original expense management software system.

This way, you can be assured that any discrepancies or errors will be found, and the maximum refund achieved.

VaTax Cloud Screen Samples

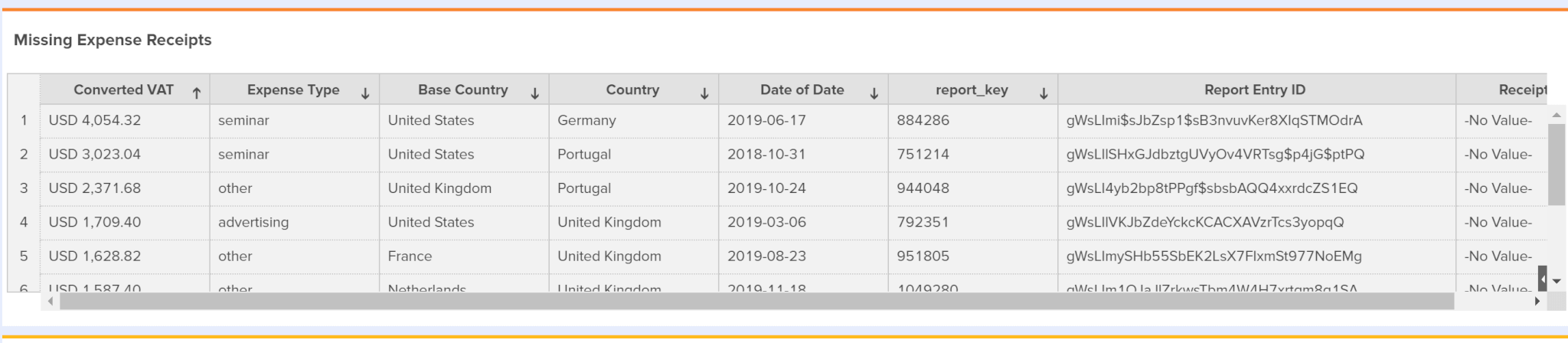

VaTax Cloud has live interactive charts displaying VAT rates per expense type and country, submission tracking, receipts, currency reports and exception reports.HOW VATAX CLOUD WORKS

Why VaTax Cloud?

VaTax Cloud streamlines the Vat & Tax recovery process. We electronically retrieve your data and invoices from any travel expense management system or you can send us an extracted Excel file via our encrypted portal. You can be assured that no VAT claim will go unnoticed.

Firstly, our backend algorithms and OCR technology ensure that even if you did not record your VAT expense correctly in your expense management software, we will pick it up and inform you.

In addition, our VAT experts verify all claims before submission. We have saved our clients significant money, just with input VAT compliance, which we will do gladly as part of our service, with no extra charge, after signing.

How does VaTax Cloud work?

After sign up and

You will have access to detailed interactive Reports – VAT potential analysis report and Submission claim process updated in real-time.

What information do we require?

Quick sign up at VaTaxCloud Signup and then

For manual extraction: Send us your extracted Excel file via your encrypted online dashboard, and VaTax Cloud will do the rest.

Free potential VAT Reclaim Report?

Security and Access via VaTax Cloud?

Triple Check System

After extensive automated – backend algorithms, OCR – and manual reconciliation, we prepare and submit all the documentation to various government offices. You receive your refund as soon as we receive the reclaim. There is always a manual check system of all data to ensure maximal reclaim potential and discovery of any automated errors or incorrect data entry on your side.

Will I see the progress?

From invoice collection through the VAT & Tax recovery process, with the money ultimately being transferred to your account – you have full visibility – Submission Analysis Report – through every step of the process and the status of every claim filed within respected countries. Interactive charts with full drill-down capabilities are a click away on your reports via your encrypted online personal dashboard.