Drop-shipping, Import VAT & Logistics

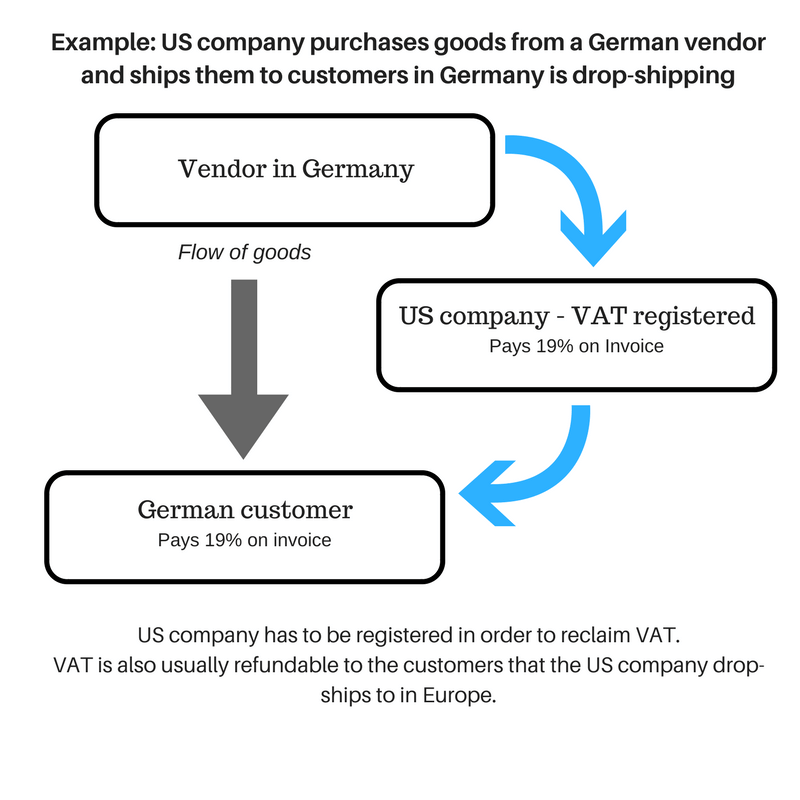

DROP-SHIPPING

Drop-shipping is when a US company purchases goods from a European vendor and then ships them to customers in Europe. Up to 27% VAT is charged by the vendor on the purchased products. In many cases, the US company will need to apply for VAT registration, and charge VAT to customers, in order to get a VAT refund.

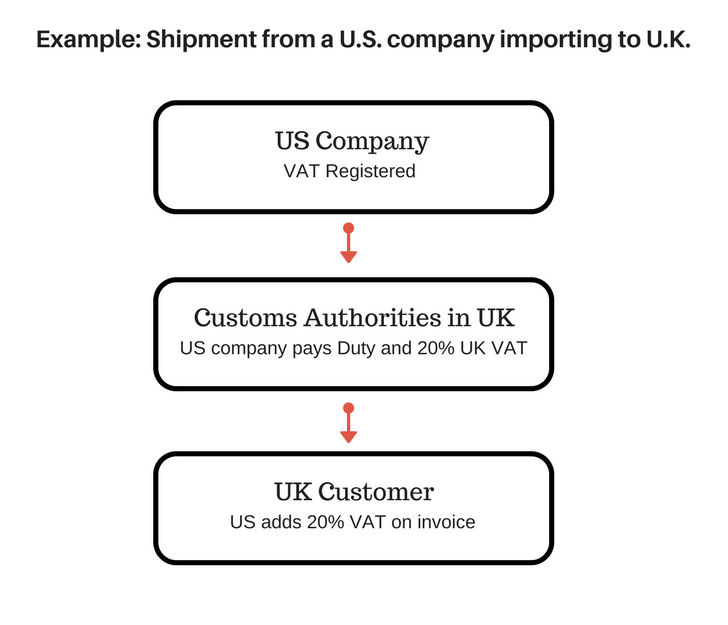

Import VAT

A US company may get a VAT charge on an invoice from a freight forwarder, such as Federal Express or UPS, when goods are imported to Europe. The VAT is often refundable. Global VaTax can also consult regarding how to issue the shipping documents in order to maximize the VAT refunds.

Logistics and Warranty Products

VAT is often charged on Logistics Services and Warranty Products purchased internationally. Sometimes VAT registration is required, and it may be necessary to charge VAT to the customer of the US company.